Business owners tend to approach accountants when they are aware of the perks they add when recruited to the team. However, not everyone is the same, and some are skeptical or outright averse to the idea of approaching one. Hiring the services of a professional accountant not only adds value but keeps your business steady and in check.

With the advent of technology and its subsequent marvels, accountants have expanded and honed their skills to generate maximum output in their respective fields. What exactly defines value might be subjective but it is universally accepted that a valuable person is the driving force behind the success of an entrepreneur or firm.

What exactly defines adding a VALUE

Value distinguishes individuals in their expertise, the benefits they offer, and the overall contribution of their skills to their employer. An accountant can be a valuable asset for an employer if they successfully improve an organization’s financial standings and contribute to its overall well-being.

Energetic, enthusiastic, passionate, competitive, and agile are some of the attributes that define valuable individuals. Their engagement and participation in the regular affairs of their employer’s venture invigorate and rejuvenate the business and enable it to thrive against its competitors.

If you want to see how accountants can structure their services to deliver even greater value, check our guide on Creating High-Value Offers for Tax Consultancy Services

How exactly is this value added?

The benchmarks for this value are directly affected by the ethos and ethical values upheld by businessmen and firms but the core concept of value is universal and general for everyone. I have recounted several ways to add value as an individual and these concepts can be expanded upon by individuals when implementing in their services.

Accountant’s Value-Add Checklist for Businesses

Create a clear financial plan with short- and long-term goals

Review cash flow regularly to avoid liquidity issues

Use ERP/accounting software for real-time insights

Perform cost-benefit analysis before investing in new projects

Identify risks and create backup financial strategies

Monitor tax compliance and regulatory updates

Translate complex financial data into simple, actionable insights

Explore automation & AI tools to save time and reduce errors

Diversify investments to minimize financial risks

Provide regular performance reports for better decision-making

Strategic Decision Making

Accountants do more than keep records. They help businesses make smart choices. Strong decisions depend on data, not guesses.

Here’s how accountants add value through strategy:

Spot hidden financial patterns that others miss

Use ERP software to collect and analyze real-time data

Allocate funds to projects that grow, not those that fail

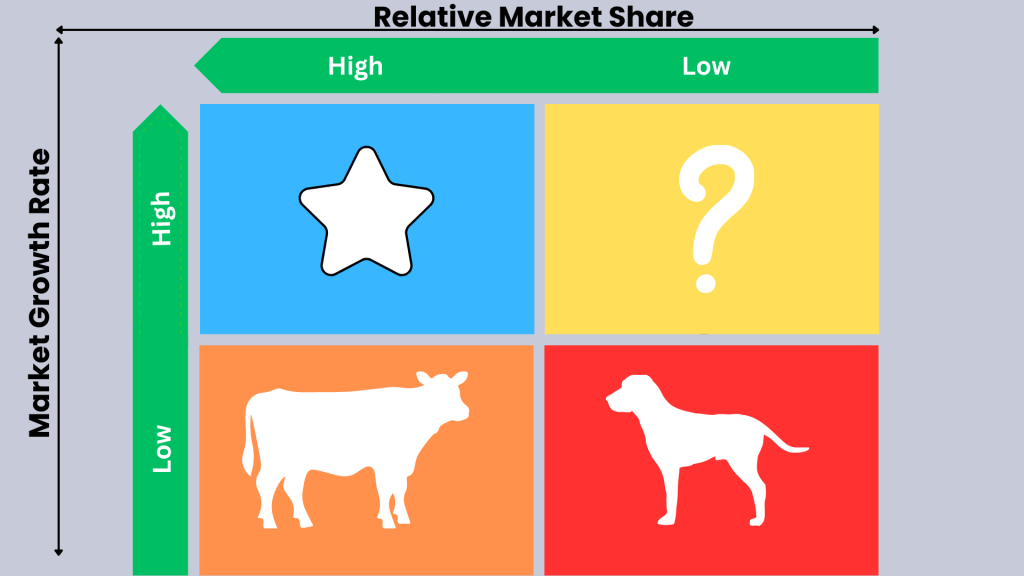

Use tools like the BCG Matrix to see where the business stands

Forecast profits and future risks using past data

Prepare different “what if” scenarios to test business plans

Study market trends to guide expansion or cost cutting

Good strategy means asking:

What is our goal?

What can go wrong?

What are the best and worst outcomes?

How do we prepare if things go wrong?

Professional accountants are adept at identifying loopholes that could undermine their employer’s financial integrity, carefully scrutinizing every detail to safeguard the business from potential threats. Their expertise and experience speak volumes in their work ethics and decisions precisely pinpointing fallacies and shortcomings.

Scrutinizing financial transactions with a check-and-balance mechanism ensures your monetary activities are safe from fraud, error, and inefficiencies. Keep an eye out on financial reports as they may allude to monetary discrepancies which if not handled properly will likely turn into disasters. You should look for unstable patterns in investments, liabilities, and incomes which will likely serve as initial whistleblowers.

Market assessment is essential to quantify financial risks including market volatility or changes in regulations. The assessor needs to keep in mind the changing nature of market as it usually changes most often and needs to be addressed when making financial decisions. Diversifying investments without limiting to a single sector ensures that you don’t keep all eggs in a single basket which poses great risk and undermines financial stability in more than one way. Either that or limiting your financial plans without excessive expenditures mitigates and balance the risk.

The domino effect adversely impacts a business’ trajectory, breaking its delicate balance based on factors such as business processes, customer interactions, market trends, financial management, and executive decisions. Accountants use their knowledge in financial affairs to fortify a business’ financial integrity.

To counter the domino effect, analyze from the foundation all the way to the top and focus on ensuring that the business has enough liquidity to meet its short-term objectives.

Review liabilities and debts to assess their impact on the financial health of the business which includes: debt covenants, interest rates, repayment schedules, and loan agreement breaches imposed by creditors.

Analyze irregularities or weaknesses in financial transactions and internal controls that might have contributed to the domino effect which includes hacking, malfunctioning devices, and tempering with physical assets.

Complex problem-solving, Exceptional Communication, and Persuasive Skills

Problem-solving is one of the rare and prized traits and implementing it can reduce mammoth problems without breaking a sweat.

Mentally sharp and keen-eyed individuals are able to intercept susceptibilities immediately after they are discovered and create an optimal solution to prevent them from turning into a problem.

Accountants need to handle unexpected market turndowns and their employer’s unexpected financial expenses avoiding potential disasters such as losing stock shares and trade deficits.

Soft-spoken individuals are preferred and valued over crude and offensive people because of the demeanor former exhibit. Refining communication and connections help you in the long run and assist you in propelling your career and your connections will come in handy when dealing with creditors and debtors.

Translating complex financial data into clear, concise, and actionable insights easily understood by non-financial stakeholders is required to create a communication channel for mutual understanding and ensures that everyone is on the same page.

Innovation and Adaptability

A professional and innovative accountant will readily embrace new and improved technology to expand on their skills. The Internet has empowered various fields with powerful tools and means of communication unheard in the history of mankind. Computers and their software have enabled us to work from home eliminating the need for commuting and traveling long distances.

A couple of handy tools you will most likely use during your professional career are QuickBooks, Xero, SAP Concur, FreshBooks, Microsoft Dynamics 365, and NetSuite ERP. You are either going to use one of these or custom-made software catering to your particular business and its needs. This is for beginners who are unfamiliar with accounting software and need to know some of the best software in the market at this moment.

Blockchain has become an industry standard for adding an extra layer of security to financial transactions, streamlining payment and remittance processes by reducing settlement times, and significantly cutting costs. This technology needs to be adopted and implemented in software utilized by the business for securing its financial transactions and monetary activities to prevent hacking and fraud.

Analyzing potential risk and approaching the peril with comprehensive and effective solutions by implementing a robust internal audit program regularly hunting for financial irregularities greatly reduces the chances of jeopardizing your monetary activities.

Conclusion

You can find new and familiar concepts laid out to help you understand the meaning of value and traverse initial hurdles of your career as well as understand traits that set professionals from amateurs. Now, the ball is in your court and only you can shape your career however you choose it for yourself.

Explore new horizons, discuss what you have learned with your seniors and mentors, and grasp and experiment with new software to learn new and exciting ways you can practice accountancy. Accounting skills are based on critical and analytical thinking to scrutinize, interpret, and classify financial data.

The actual values that distinguish professional and highly qualified accountants from amateurs and beginners are based on their depth of knowledge, experience, ethical integrity, technological expertise, and ability to act swiftly in adverse and complicated circumstances.

I’m Maqsood, a freelance writer specializing in finance and tech. With experience crafting content for dozens of companies worldwide, I turn complex ideas into engaging stories that connect with audiences. From fintech trends to tax tips, I bring expertise and creativity to every project, delivering content that drives results.

Share via: